The Mortgage Market’s Misleading Buy Signals

Introduction: The Danger of Buying on Fictional Signals

In today’s mortgage market, consumers are regularly bombarded with “headline rates”, slick illustrations, and alluring “best buy” tables. But buried within the details of these offerings lie calculations that can be actively misleading — Annual Percentage Rate of Charge (APRC), reversionary rates, and total cost over term; being the main offenders.

While these metrics were introduced with the aim of transparency, they risk distorting buyer decision-making. Too often, borrowers choose a mortgage product based on hypothetical, long-range assumptions — ignoring the far more practical reality that most borrowers don’t keep the same mortgage for 25 years; and likely shouldn’t. This article explains why it’s time to adopt new benchmarks.

What Are APRC, Reversion Rates, and Overall Cost — and Why Do They Mislead?

APRC (Annual Percentage Rate of Charge)

The APRC is intended to show the annual cost of a mortgage, averaged over the entire term (usually assumed to be 25 years), and including interest, fees, and charges. It’s meant to allow an “apples-to-apples” comparison between different mortgage products.

But this logic breaks down in practice. Most borrowers remortgage every 2 to 5 years. Few — if any — ride out their initial deal only to sit on their lender’s reversion rate for the next 20+ years. So, including that reversionary period in the APRC becomes not just irrelevant, but actively deceptive.

Moreover, by extending the calculation across decades, lenders can make a product look cheaper overall — even if it costs more during the period you’ll actually keep it.

Reversion Rates

The reversion rate is the variable interest rate you fall onto once your initial fixed, tracker, or discount deal expires. The rate is usually the lenders standard variable rate which itself is not formally tied to the Bank of England base rate and is entirely at the lender’s discretion to alter (although a few lenders may offer a reversion rate which is linked to the BOE rate with a significant margin applied).

The issue? Reversion rates can move significantly during the term of your initial deal. A lender whose SVR seems competitive today may be wildly uncompetitive two years from now. As the reversion rate is used in calculating the APRC, then the resulting figure is based on a complete fiction.

It also incentivises bad behaviour — the borrower who doesn’t switch products at the end of their term is effectively penalised, while the product looks better on paper to those who assume they’ll always remortgage. It’s a lose-lose.

Overall Cost Over Term

Mortgage illustrations show the “total cost” of a mortgage over the term, typically 25 or 30 years as well — treating the reversion rate as statis and assuming no changes in behaviour. Again, this assumes the borrower never switches lender, never redeems early, never moves house, and never makes overpayments. This is rarely the case.

And because this figure is calculated using the reversion rate for all years beyond the initial deal, it embeds the same misleading assumptions that plague the APRC.

Why the Reversion Rate Should Be Largely Ignored

For most customers, there is simply never a time to be on a reversion rate in day-to-day trading.

The circumstances where a reversion rate would be competitive are extremely rare. And even for someone who believes they are selling their home and have a new mortgage application in mind; the existing loan could frequently be converted to a deal with no early repayment penalties on a significantly lower rate and redeemed without loss.

If that house sale falls through though, and three months turn into a year, then that switch could save thousands and take a matter of hours to affect.

It’s extremely rare for a reversion rate to compete with new product offerings. So, unless you have such a small balance remaining on your mortgage that large changes in rates amount to differences of a couple of hundred pounds a year, the effort involved in switching is almost always warranted.

And yet: there is no regulatory obligation to advise customers to shop around before their deal ends, but there is an obligation to include outmoded cost indicators that bear little real-world value.

The Right Metric: Cost of the Initial Deal Period

If most borrowers remortgage every 2–5 years, then the most useful comparison metric isn’t the APRC — it’s the effective cost of the initial deal period, taking into account:

- Initial interest rate

- Product fees (including arrangement and valuation costs)

- Cashback or incentives

- Exit charges or early repayment charges (ERCs)

- Legal or broker fees (where applicable)

- Trailing interest (some lenders may lock you into a month of interest at the higher reversion rate at the end of the deal, equivalent to a hidden fee of a few hundred or even thousand pounds depending on loan size).

This provides a far more grounded basis for comparing one deal to another in a meaningful way — i.e., the way most borrowers actually behave.

But even this needs to be done properly. Comparing “costs” based on monthly payments alone ignores the amortisation structure — how your payments are split between interest and capital. A product with a slightly higher rate but lower fees might cost less overall over two years than a low-rate, high-fee option.

Why You Need to Use an Amortisation Calculator

Accurate product comparisons require more than looking at monthly payments or percentage rates. They require amortisation analysis — a breakdown of exactly how your loan is repaid over time.

A mortgage amortisation calculator allows you to:

- Compare total interest paid during the initial deal

- Assess the impact of fees and incentives

- See how early repayment or overpayments affect the cost

- Plan refinancing strategies with real figures, not illustrations

Far too many borrowers simply take a rate and apply it to the loan balance without factoring in fees, repayments, or even time. That’s not enough.

A robust amortisation tool is essential if you want to optimise your borrowing strategy over time — especially if you’re the kind of borrower who proactively manages your debt.

Conclusion: It’s Time to Retire APRC in Favour of Real Cost Comparisons

The APRC and total-cost-over-term metrics served a regulatory purpose. They aimed to force consistency in advertising and encourage disclosure. But they’re now little more than a compliance formality — and in many cases, a dangerous distraction.

The industry — and borrowers — need to focus on real costs, over real horizons, and ensure that product comparisons reflect how people actually manage their mortgages.

Until we replace the APRC with something that captures that reality — ideally, a cost-over-initial-period metric backed by amortisation data — buyers will continue to be lured by the wrong signals, and some will pay thousands more than they needed to.

Many self-employed applicants believe they’re at a disadvantage when it comes to securing a mortgage.

But the problem isn’t eligibility—it’s self-advising. The rules lenders apply to income calculations for the self-employed are often complex, technical, and vastly different from one another. What confuses many is not whether they can get a mortgage, but how their income will be assessed—and how that assessment can swing their borrowing potential by tens or even hundreds of thousands of pounds.

This post unpacks the different classifications of self-employment—sole traders, limited companies, partnerships, LLPs, and contractors—and examines how lenders treat each. Whether you’re new to self-employment or an experienced business owner, understanding this will give you clarity—and a significant advantage when applying.

When Are You Considered Self-Employed for a Mortgage?

You may think you’re employed, especially if you’re on payroll—but if you own 20% or more of the business you work for, many lenders will treat you as self-employed and virtually all will work this way if you exceed 24% ownership. That means you’ll need to provide different types of income evidence than a standard employee would.

Being “self-employed” in the eyes of a lender doesn’t just refer to being your own boss—it’s about ownership, control, and liability.

How Sole Traders Prove Income: SA302s, Accounts, and Lender Variations

What is a Sole Trader?

A sole trader is a self-employed individual who owns and operates their business as a private individual. There’s no legal distinction between personal and business assets. It’s the simplest business structure in the UK and often used by freelancers, tradespeople, and consultants.

How Lenders Assess Income

Lenders will nearly always ask for:

- SA302s (tax calculation summaries from HMRC)

- Tax Year Overviews (TYOs) confirming tax paid

They’ll typically use your taxable profit as the income figure. But this is where it gets nuanced:

- The number of required years trading will vary; giving differing lending amounts.

- Some lenders may allow adjustments for capital allowances (like investment in equipment) which reduce taxable profit but don’t are not ongoing expenses.

- A small number may instead use operating profit from formal accounts—but only when these are professionally prepared.

Limited Company Directors Mortgage Rules: Salary, Dividends, and Retained Profit

What is a Limited Company?

A limited company is a distinct legal entity from its owners (directors/shareholders). Profits belong to the company, not the individual, and are typically paid out as a mix of salary and dividends.

How Lenders Interpret Income

This is where things really fragment:

- Some lenders use salary + dividends reported on SA302s. But other will use the company accounts, offering two different year ends, and very different lending amounts.

- A few consider retained profits (undrawn earnings left in the company) using:

- Net profit before tax

- Or operating profit (with or without director’s remuneration)

Different documents often cover different time periods, so two lenders may assess two different years—leading to wildly different loan sizes.

And if your company has:

- Large retained profits

- Heavy capital allowances

- Temporary R&D losses

- Or rapid growth in recent trading

…then some specialist lenders may ignore these anomalies or allow income to be based on just one year’s strong performance.

In short: your income could be £30,000 or £130,000 depending on which lender is looking.

Directors Loan Account Income in a Mortgage Application

Some company directors will be drawing income from a “directors loan account”. Often this is a notional deductible for tax-purposes created when parts of a business are sold or transitioned from one type of ownership to another.

Whilst great for tax purposes; directors loan account income is relatively toxic from a mortgage point of view with most lenders refusing to consider it. However, some may and this will be an income type where it highly unlikely you will successfully self-advise on a mortgage.

LLPs and Partnerships: Mortgage Evidence Rules for Business Partners

What is a Partnership or LLP?

A Partnership shares ownership and liability between individuals. A Limited Liability Partnership (LLP) allows partners to limit personal liability, functioning somewhere between a general partnership and a limited company.

Lender Preferences

Many lenders will look at:

- Your share of taxable profit from SA302s

- Tax year overviews

- Sometimes, partnership accounts showing total firm performance

However in LLP’s:

- Some lenders require returns from all partners, which can be extremely prejudicial in firms like law practices with 100+ partners.

- A few lenders may exclude unusual deductions (e.g. one-off R&D costs) or base assessments solely on the applicant’s income share.

Once again, approaches vary significantly. Some focus strictly on the individual; others scrutinise the firm as a whole. So using a competent mortgage advisor will make the process far simpler.

How Many Years of Accounts Do You Need for a Self-Employed Mortgage?

- Most high-street lenders want two years of accounts or tax returns.

- Some prefer three years, especially if profits are volatile.

- A growing number of lenders—both high street and specialist—can work with just one year of trading, especially with strong performance and sector stability.

This is key for startups or professionals transitioning into new business models. The quality and consistency of the accounts often matters more than time alone.

Changing from Sole Trader to Ltd Company: Does It Affect Your Application?

Switching from one business type to another? Lenders may see this as a continuation or a new venture—and it’s not always clear-cut.

Common Examples:

- Sole trader incorporating into a limited company: Some lenders treat it as the same business. But if a new shareholder (like a spouse) is added for tax planning, others may deem it a new business entirely.

- Running both sole trader and limited company simultaneously: This is usually problematic as one side of the income is decreasing significantly (and therefore often disregarded) whilst the other increases (and therefore gets averaged down). Avoiding this arrangement is generally best for mortgage purposes.

- Changes in trading activity: If your business has entered new markets or taken on new partners, many lenders will reset the clock on required trading history.

Can Contractors or CIS Workers Be Treated as Employed by Lenders?

What Are CIS and Day-Rate Contractors?

- CIS (Construction Industry Scheme): Self-employed but paid with tax deducted at source.

- Day-rate contractors: Typically IT, engineering, or creative professionals with consistent contracts.

How Lenders Treat Them

Some lenders assess these individuals as employed, using:

- A calculation like day rate × 5 × 46 weeks

- No need for two or three years of accounts

This can be especially helpful for:

- People who’ve just gone self-employed

- Those transitioning from salaried employment in the same industry

- Applicants with day/weekly contracts at equivalent or higher income levels than before

But this is an area where many lenders will not treat you in this preferential way, and for those that do it is dependent on lots of other widely varying criteria like income level, contract duration, length of industry sector experience etc. Hence using a mortgage broker is a good idea to navigate this complexity.

Why Income Evidence Changes How Much You Can Borrow

Even among reputable high street lenders, loan sizes can vary significantly based on:

- Income calculation method (SA302s vs accounts)

- Treatment of capital allowances

- Consideration of retained profits or R&D losses

- Number of trading years accepted

It’s not uncommon for one lender to offer £120,000 while another offers £320,000 to the same applicant.

Why You Should Use a Mortgage Broker if You’re Self-Employed

If you’re self-employed—whether as a sole trader, LLP partner, contractor, or limited company director—your mortgage journey is entirely navigable, but not intuitive.

Getting it right means:

- Understanding how lenders interpret income

- Knowing which documents to present—and when

- Matching your business structure to the right lender criteria

But this is only one aspect of your application, and all the others are equally complex and varied. And that’s why an experienced mortgage adviser makes the difference. We help ensure you’re assessed accurately and fairly, maximising your borrowing potential with the minimum of stress.

When it comes to building your credit profile, the internet is awash with well-meaning advice. Credit reference agencies often promote a strategy of regular borrowing, spending on credit, and applying for new lines of credit to “build a score.” But for many aspiring homeowners—especially those early in their UK financial journey—this guidance can be more harmful than helpful, at least in the short term.

This article explores how credit scoring really works when it comes to mortgage applications, why “building credit” through borrowing may backfire, and why you may already be mortgage-eligible—even if you’ve never had a credit card.

The Credit Building Myth: Why More Isn’t Always Better

Credit reference agencies like Experian and Equifax frequently advocate a proactive approach to credit building: take out a credit card, use it regularly, repay in full, and consider increasing your credit limit over time. These actions, they argue, demonstrate responsible borrowing and improve your score.

But here’s the catch: these same activities often create red flags for mortgage lenders.

- Too many credit applications in a short space of time? That’s a hard search footprint spree—mortgage lenders might see you as financially desperate. It’s also a high-risk indicator for identity fraud.

- Multiple credit cards or high balances, even if managed well? That can raise concerns about your overall debt-to-income ratio and signal over-reliance on credit or a debt appetite that could become unhealthy.

- New lines of credit shortly before a mortgage application? Many lenders interpret this as financial instability.

So, while your numerical score might be inching upwards, your mortgage eligibility could be quietly sliding downwards.

What Lenders Actually Want to See

Contrary to popular belief, mortgage lenders don’t just look at your “credit score” as a magic number. They consider a broader financial portrait, including:

- UK address history (residency length and consistency)

- Presence on the electoral roll (if possible)

- Current credit commitments (and how stretched they make your finances)

- Bank account stability

- Affordability assessments based on income—not just credit

In fact, most applicants with just one or two UK current accounts, a mobile contract or a utility bill will pass credit scoring—even at high loan-to-value ratios—after just a year or two of UK residency.

This is especially true if they’ve kept their credit history clean (i.e., no missed payments, defaults, or excessive credit usage) and have consistent address history.

Other factors also affect things. Regularly moving home, borrowing high income multiples, or financial pressures like having dependents may also impact your score.

No Credit? No Problem—Sometimes

A common misconception is that “no credit history” equals “bad credit.” But this isn’t always the case.

There are plenty of borrowers who have:

- Never taken out a credit card

- Never had a loan

- Lived in shared accommodation since childhood (so no bills in their name)

- Just opened their first UK current account

And yet—they pass credit scoring for a mortgage.

How? Because lenders weigh up a combination of risk factors. For many mortgage providers—especially those operating in the high loan-to-value space or serving younger borrowers—the absence of credit data is not automatically a dealbreaker. It’s certainly better than a credit file littered with missed payments, payday loans, or an overabundance of credit utilisation.

To put this into context: we recently had an application approved by a high street lender, on top-tier rates, for a foreign national with only 18 months’ UK residency, a 15% deposit, and no credit data at all. She was also a fixed-term contractor.

On the flipside, we’ve seen applicants with very high incomes, good credit history, big deposits, and high scores declined for reasons such as over-utilisation of available credit or an excessive debt-to-income ratio.

What Does Harm Mortgage Eligibility?

Here’s where the contradiction becomes obvious. While general credit advice pushes borrowers toward more borrowing, the factors that can seriously harm your mortgage chances include:

- Multiple hard searches in the last 3–6 months

Lenders see this as high-risk behaviour. It suggests financial strain or desperation.

- Too many active credit lines

Even unused cards can cause concern because of potential borrowing power.

- High credit utilisation

Using more than 30% of your available credit—especially if near the limit—can make you seem financially stretched.

- High debt-to-income ratio

Even if all your payments are up to date, owing sums that account for a high proportion of annual income indicates a higher risk of default.

- Short UK residency

Newcomers are already subject to stricter scrutiny. Layering risky credit behaviour on top can lead to an outright decline.

Incorrect information is also a major factor in failed credit scoring for those with limited credit data.

Credit scoring is a risk assessment system. The less data held on an individual, the greater the importance of consistency. With the rise of online account management, it’s easy to forget to update your address on your mobile phone, PayPal account, or a dormant bank account.

But inconsistency heightens the perception of risk. So it’s vital for those with limited data to ensure their records are consistent, up to date, and accurate.

We even saw one applicant declined—despite a good income, clean credit, and a large deposit—simply because he had numerous accounts under his nickname “Brad” instead of his legal name “Bradley”. Issues like this can take months to fix, so address them as early as possible.

A Smarter Approach: Focus on Stability & Accuracy—Not Activity

If you’re planning to apply for a mortgage in the near future, the best credit advice is actually quite simple:

- Avoid new credit applications for at least 3 months before applying.

- Don’t take out credit unless absolutely necessary.

- Keep existing accounts open and in good standing—but use them sparingly.

- Register on the electoral roll at your current address if eligible.

- Maintain consistent UK address history.

- Get your statutory credit report for free from Experian, Equifax, and TransUnion.

- Ensure your information is accurate: use your full legal name, correct date of birth, and current address across all active accounts.

- Use a good mortgage advisor.

In short, less is often more. Yes, it’s in our interest to suggest using a broker—but it’s also in our interest to help you succeed. If you’re declined, we don’t get paid either. That’s why we work from a “first, do no harm” perspective—using credit checks sparingly and only with lenders aligned with your profile.

Final Thoughts: Rethink the “Credit Score Game”

The idea that you must be constantly borrowing to prove your creditworthiness is deeply flawed—especially in the mortgage world. For many borrowers, particularly young adults and new UK residents, overplaying the credit game can actively harm short-term eligibility.

Mortgage lenders want to see financial responsibility, not financial activity. That means stable accounts, low or no debt, and consistent behaviour—not a long list of hard credit checks or juggling multiple cards.

While using credit doesn’t inherently harm your score—and may help build it over time—it’s not a panacea for credit worthiness.

Before you take out that next credit-builder card or personal loan, ask yourself:

Is this helping me in the long term—or just ticking a box on a generic credit checklist?

In our Q&A, we answer some of the questions mortgage advisors answer regularly.

Question; I hear it is difficult to arrange a mortgage on a freehold flat; why is this, and is it possible to mortgage one?

In a freehold property, you are responsible for the maintenance and insurance of the building and own the land attached.

In the case of a typical house, this is a good thing. However, in the case of a flat, there may be no clear definition of who is responsible for various parts of the building.

Your ceiling may also be a neighbour’s floor, and your floor, another neighbour’s ceiling.

Imagine that your upstairs neighbour leaves his bath running and your roof collapses; whose responsibility is this now?

If your neighbour has no insurance, it could get pretty messy, and that is why it can be a no-go area for many mortgage lenders.

But, the question of mortgaging freehold flats can also turn into something reminiscent of a Monty Python sketch.

Where the plot thickens; is in what context may the property be considered a freehold flat?

Freehold flats in Scotland

If you are buying in Scotland, especially if you live in the rest of the UK, you may be unaware that there has never really been an equivalent to leasehold property in Scotland.

So a property listed as a freehold flat is not a big issue over the border.

Properties that own a share of the freehold

Properties that own a share of the underlying freehold are not themselves freehold.

The property will have a lease and may need to pay service charges and ground rent, just like any other leasehold property, although some have no regular charges payable.

When a lease requires an extension, it is still a costly process.

Their main advantage over a leasehold flat is that you have some say in managing the freehold with the other owners; you would hope this means that charges should be more fairly administered.

These properties are often sold and listed as freehold, with the blissful ignorance of the vendor, estate agent and even the lenders’ surveyors.

Who, for reasons unknown to science, are usually considered bastions of fact in complex legal matters; despite having no relevant qualifications in the field; instead of the lender checking the land registry.

What ensues is mortgage applications being rejected based on properties being freehold on the hearsay evidence of an estate agent.

If you have found yourself in this situation, we should be able to help. These properties are normally acceptable to many mainstream lenders.

Many still have complex rules about the share of the freehold and how it is owned and managed, so it is vital to select the right lender. But if you have found this problem, we should be able to help.

Properties with a long lease or lifetime lease

On occasion, a property with a long lease of 999 years, or thereabouts, will be described by a vendor as freehold, under the impression that it is ‘as good as freehold’.

Often, when there is no service charge, ground rent, or a ‘peppercorn ground rent’ of £1 per annum, sometimes a service charge or ground rent is payable, but the freeholder is absent.

If the freeholder is known and the vendor is just misrepresenting the property as freehold then the situation is readily fixed by asking the vendor and agent to tell it like it is.

An AWOL freeholder can present different problems beyond the scope of this post and is something to discuss with your conveyancer or solicitor, but aren’t the boon they may appear to be.

In most cases, we can help you arrange a loan on these properties; if the freeholder is absent, consider this problem before getting seriously involved in the purchase.

A freehold flat or maisonette where the remainder of the properties in the block are leasehold

A more complex scenario is a property that owns the freehold of a block, and the remaining properties within it are leaseholds and owned elsewhere (in blocks of no more than 4 flats).

These are often they are created when someone converts a house into flats and retains ownership of one of those properties.

The vendor of such a property will usually make it very clear that it is freehold, as there is a public perception of this being preferable due to the often unfavourable costs of service charges, ground rent and for occasional lease extensions imposed by many freeholders.

Many lenders will not accept these properties. For those that can, you might often have to deal with a certain amount of objection due to the uncommon nature of this arrangement and the confusion with flats in a block where all the flats are freehold.

For this reason, you will find it very difficult to arrange a mortgage on such a property without a competent advisor.

Generally, a mortgage on these properties should be possible with mainstream high-street lenders, although many may still be unsuitable. Get in touch with us for help on these.

A freehold flat or maisonette where the remainder of the properties in the block are freehold

This is where things get a lot more complex.

For these properties, there is a very small number of potentially suitable lenders and suitability is usually determined by the legal arrangements between flats in the block and general marketability.

Many such properties are either impossible to obtain a normal mortgage on or mortgageable at rates comparable to bridging finance. Some though will have a limited number of mainstream mortgage options that are suitable. Others like Tyneside Reversion arrangements might be more commonly acceptable.

Such properties may often be marketed as cash purchase only or even sold at auction. In the case of a cash purchase, the agents may have agreed to sell the property this way based on other factors, such as property condition but generally this may be an indication that it is a property unsuitable for a traditional mortgage. Again, this may have caused a decision to sell at auction.

So do not treat any indication that a property can be mortgaged as final, and you should be prepared to risk losing your deposit if you intend to purchase such a property at auction and require a mortgage.

If you are intrepid enough to try and mortgage such a property we can help.

But expect that such a purchase could significant time as it might have to be sanctioned by the lender’s internal legal team, which is a notoriously slow process that often takes several weeks.

I’ve decided to write about the real costs of advice to consumers, to dispel some of the myths and preconceptions.

As a forward, I thought I’d explain my misconceptions prior to getting involved in financial services sometime back in 2005.

A few years earlier price comparison websites had appeared in the market launching with the message that they “cut out the middleman” and offered better value to the customer by removing their “margin” on the deal.

So before I started working in mortgages I believed that a broker was someone who took a product, added their percentage on top and sold it on.

Since working in the industry though, I have realised there is a myriad of similar misconceptions floating around.

Some people think the arrangement fees on a mortgage deal are to pay the broker.

Some are convinced the lender will offer a better rate direct.

But are any of those assumptions even remotely based on reality?

Let’s start with the idea that middlemen just add margin onto a products price.

I’m a keen photographer and if you share my interest you might well be familiar with the absolutely awesome Sony a7 range.

I won’t waste your time taking you on a photography lesson. But I will show you what you already know.

This picture above is from the Sony UK website for an A7 with kit lens showing a retail price of £1509.00 today on 08-06-2018.

Now we have the same camera and lens on sale with a “middleman” called Jessops and it is, after cashback 50% of the list price on the same day.

Sony’s own retail shops are selling the body only for the same price Jessops offer with the kit lens and the lens is upwards of £400 on its own.

In short buying direct from the manufacturer could cost you twice as much.

But you already know this. You already know that the idea of middlemen adding cost to everything is a fallacy.

Distributors in every industry will often have superior deals. We all see this every day.

Most of us have seen Trivago girl a million times telling us how they compare all the different prices for thousands of hotels daily, but does anyone really think you would get the best deal by phoning the hotel?

So how does pricing in the mortgage industry really work? And how much does our advice cost you?

Lenders whose products are the same through every channel.

Some lenders offer the same range of deals through every channel and have made promises to the market to never do what we call dual pricing.

This means whoever you go to be it direct to the lender, or any broker the deals available will always be the same.

Examples of this are Barclays and Coventry Building Society but there are many others.

For these lenders, if the broker offers you a fee-free service the lender is paying the cost of our commission.

You need to be aware though, that we might recommend a product based on best value for money, and another adviser might just recommend the lowest rate.

You need to discuss with both parties to work out why two different deals might have been recommended.

But if you have access to all the same deals through both, then you cannot be paying the cost of advice unless the advisor is charging an additional fee.

And this should not be confused with a product booking or arrangement fee.

Lenders will usually release multiple rates at the same loan to value.

Some with a lower rate, and an arrangement fee (often around £999) and other deals with no arrangement fees and slightly higher rates.

This is just offering deals to appeal to different customers with different sized loans and has nothing to do with the broker.

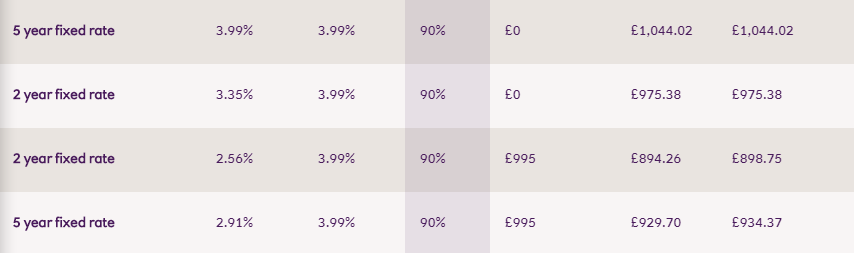

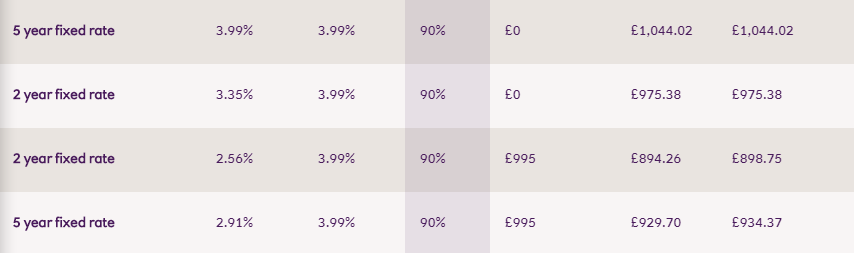

You can see in the example below Natwest offering various two-year fixes with different fees and cash backs.

And the best value product for each customer would depend on their loan amount, term, whether it was a repayment mortgage, and whether they would have to add the fee to the loan.

Lenders who do offer different prices and product ranges.

Other lenders like Natwest, for example, do offer different ranges direct at times to those they offer through brokers.

So, the assumption is that using us is going to be more expensive, right?

Think again.

For various reasons lenders might offer much cheaper products via a broker than they do direct. As counter-intuitive as this may seem.

Below are two more screenshots from February this year.

Disclaimer – These rates and products were available in Feb 2018 but are used for example purposes only and are no longer available.

The first is from our sourcing system showing deals available with NatWest at 90% loan to value.

The product highlighted in black with yellow text and the product in blue text are both exclusive rates offered through various mortgage clubs for brokers at the time.

And then below are all the deals NatWest were offering to customers via their website at the same time.

Notice that our exclusive 2-year fixed was 0.5% cheaper than their direct deal, despite the lender paying us a commission of around 0.32% (the total is actually more as some will go to the mortgage club too).

So why on earth would the lender offer deals through brokers that in total cost them more than 0.82% in profits against their direct business?

You have to think about what we actually do because the lender would have to do all the same work.

That’s a professional adviser spending several hours on the phone to each customer. Hours spent processing documents, completing application forms, preparing compliance files and suitability reports.

They need the staff to cover this in a seasonal industry, so they would then have little to do half of the year. Those staff members go onto their pension scheme and pay national insurance and tax on their incomes.

They need to cover professional indemnity risks, telecoms cost, office space, computers, training, and development, staff turnover, and recruitment.

And then there is the fact that the broker market is also an advertising channel and comparative to paid advertising.

Now, this doesn’t mean that we will always have better deals with every lender. Often there will be little or no difference at all.

On occasion, their direct deals might be better.

Sometimes we will offer something a lot cheaper with the same lender. Other times our deals might not be as good.

Basically, there is no way to guarantee you get the best deal.

So the question really becomes one of time, stress, convenience and quality of service.

Do we end up pursuing the “best deal” when the cost of doing so outweighs the benefits?

I think the answer here comes down to the differences between using a broker and going direct.

In my view, with a good broker, you are going to be every bit as likely to get the best possible deal as you would be searching the market yourself with the difference being you don’t have to go through the hassle of doing that.

You’re also more likely to be protected from significant pitfalls.

I am going to follow this article with some others, one which highlights a life insurance provider whose contractual terms are so poor in comparison to their rivals I cannot justify recommending them and another one about the possible pitfalls of not taking advice.

Each article highlights how self-advising without a professional level of knowledge about implications like taxation, and different contractual terms could see you buy a cheap deal that incurs huge additional costs amounting to tens or hundreds of thousands of pounds over a lifetime.

Now we don’t want to scaremonger or imply that these risks apply to every transaction, but the point is to highlight the real benefits of advice that extend far beyond simply getting a good deal or better service and that even if that occasionally costs you more, it’s probably a cost worth paying for.

So make sure to come back and check out those articles over the next few weeks.